When seeking Charlotte, NC Health Insurance, we are confident we will be able to assist you in finding the correct plan for your current lifestyle. We will take the time to explain what is covered in your policy and which network you are in.

Some of the commonly asked questions related to Charlotte, NC health insurance are as follows:

- How Long Does it Take to Get My Blue Cross NC Health Insurance Card?

- Why Should You Choose an NC Health Insurance Agent/Broker Over Healthcare.gov

- Does Age or Being Male or Female Change the Price of Medicare in NC?

If you have any other questions related to signing up for health insurance or changing your current North Carolina health insurance plan, we look forward to hearing from you.

Blue Cross NC Health Insurance

Mecklenburg County, NC Health Insurance

Charlotte, NC Medicare for Those Turning 65 in 2021 or 2022

Our team of healthcare insurance professionals can assist you with any questions you may have when it comes to Charlotte, NC health insurance plans. Having some of the most educated and experienced agents in the Charlotte area allows our clients to know exactly what the Blue Cross NC insurance plan covers. There should be no concerns as it pertains to what is covered in relation to a hospital visit, prescription drugs or annual check ups. We will go above and beyond to educate you and your family on the Blue Cross NC health insurance options. If you are wondering if the 2021 healthcare bill will affect Charlotte residents, call The Mair Agency now.

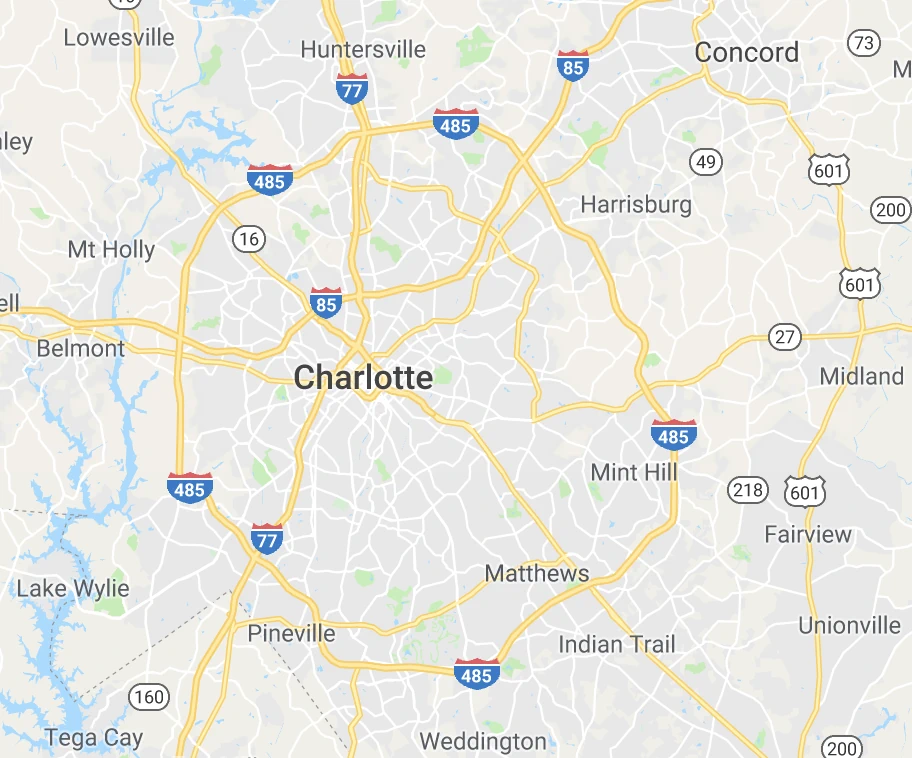

Charlotte, NC Growth

Charlotte, North Carolina is the largest city in the state and is an area in which the population has grown tremendously over the last two decades. In 1999, the population of Charlotte was 520,829. In 2016, the population was 842,051. The general Charlotte area population is around 2.5 million. We suspect this number will continue to grow as more and more business professionals and young families flock to the area with the high quality schools and fantastic job market.

The largest employers in Charlotte, NC are as follows:

- Carolinas HealthCare System

- Wells Fargo & Co.

- Wal-Mart Stores Inc.

- Bank of America Corp.

- American Airlines Group

- Charlotte-Mecklenburg Schools

- Lowe’s

- Novant Health

- City of Charlotte

- Daimler Trucks North America LLC

- Duke Energy Corp

- Food Lion LLC

- Harris Teeter

- North Carolina State Government

- U.S. Government

- AT&T North Carolina

- Cabarrus County Schools

- CaroMont Health Inc

- Compass Group

- Gaston County Schools

- Mecklenburg County

- Rowan-Salisbury Schools

- Target Stores

- TIAA-CREF

- Time Warner Cable

- U.S. Postal Service

- Union County Public Schools

- University of North Carolina at Charlotte

Relocating to Charlotte

We have a great deal of experience when it comes to relocating to Charlotte, North Carolina. Whether you are looking for a local credit union or bank, the best schools, a pest control company or the location of the local DMV, we can assist. Do not hesitate to reach out to us if you have any questions about moving to the area. We are also aware of the top retirement communities and the aging in place communities. If you are a senior looking to downsize into an apartment or are looking for the best places to retire in Charlotte, we can offer some advice.

If you are new to the area and are looking for temporary or self employed health insurance, make sure to contact The Mair Agency today. We can assist you in finding the right insurance policy to fit your needs.

If you happen to be retiring to the area or are looking for Medicare options, we have a great deal of experience in this subject matter. We have a team of health insurance professionals that can assist you with Medicare Part A and B or Medicare Supplements. We will work diligently to make certain you have the right Medicare plan.

Mecklenburg County Health Insurance

In Mecklenburg County, Blue Cross NC offers Blue Value, Blue Local with Carolinas HealthCare System. If you would like to learn more about the options that are available to you in Charlotte, North Carolina contact us today. He will go over all the options when it comes to Blue Cross Blue Shield of North Carolina. He will also be able to help you get a health insurance rate quote today.

Blue Cross NC Dental

When Charlotte area residents are choosing a health insurance plan, they often inquire about dental coverage or dental insurance. Rather than having to pay $200 for every cleaning at your local dentist, it might be worth it for you to add the Blue Cross NC Dental Plan to your healthcare coverage. Note that not every dental procedure is covered by insurance. Do not assume dental implants, dentures, tooth extractions or other types of oral surgery will be covered by dental insurance. That said, if you would like to better understand Blue Cross NC Dental Plan coverage in Charlotte, North Carolina, contact The Mair Agency today.

KEY MEDICARE TERMS TO KNOW

When you’re shopping around for health insurance plans in Charlotte, you’re sure to come across many Medicare-related terms. It’s a good idea to familiarize yourself with what they mean. Of course, if something is unclear or doesn’t make sense to you, we encourage you to reach out to our Medicare experts. We specialize in Medicare and will be happy to help. Here are some of the most common Medicare terms you should know.

Types of Medicare

- Medicare Part A: Medicare Part A is essentially hospital insurance.

- Medicare Part B: Medicare Part B refers to doctor and outpatient insurance.

Original Medicare: Medicare Part A and Medicare Part B make up Original Medicare. - Medicare Part C: Also known as Medicare Advantage Plans, Medicare Part C is offered by private health insurance companies. It comes with the benefits of Original Medicare plus extra perks like dental coverage or wellness services.

- Medicare Part D: Medicare Part D is prescription drug coverage. You can purchase it separately as a standalone plan or include it in a Medicare Advantage plan.

Costs of Medicare

- Premiums: The fixed amount of money you pay to Medicare directly or a private insurance company. Your premiums will depend on a number of factors including plan type, provider, and location.

- Deductibles: Your deductible is the set amount of money you pay out-of-pocket for covered health care costs before your Medicare plan starts to kick in.

- Copay: Your copay refers to the amount of money you pay when you receive a covered service. The service along with your coverage will determine your copay.

- Coinsurance: Sometimes, you’ll split the cost of a service with your plan. For instance, you may be responsible for 20% while your plan covers the remaining 80%.

- Benefit Period: Benefit Period refers to how Medicare Part A measures your use of skilled nursing facilities and inpatient hospital services.

Medicare Acronyms:

- AEP: Annual Enrollment Period, which occurs every year from October 15 to December 7. This is when you can add, switch, or drop coverage.

- IEP: Initial Enrollment Period, which may be during the Medicare AEP. Your IEP may be different if you’re eligible for Medicare due to a disability or other unique circumstance.

- SEP: Special Enrollment Period is an enrollment period outside of traditional enrollment periods like IEP. You’ll need to meet certain criteria to be eligible for a SEP.

Care Plan Acronyms

- HMO: Health Maintenance Organization that requires you to use hospitals and doctors within your plan’s network.

- POS: Point of Service allows you to use hospitals and doctors outside of the network. The caveat with this plan is that you may be on the hook for a higher copayment or coinsurance.

- PPO: Preferred Provider Organization enables you to use hospitals and doctors within the network or outside of it. Keep in mind you may have to pay more if you go outside.

- SNP: Special Needs Plans are designed for people with a variety of special health care needs such as diabetes.