What Exactly Is Medicare?

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older.

While it mostly covers those older in life, it also covers certain younger people with disabilities or specific health conditions like End-Stage Renal Disease.

The program helps cover a range of medical services, including hospital stays, doctor visits, and preventive care. While it significantly reduces out-of-pocket healthcare costs, it doesn’t cover all expenses, such as most long-term care services.

Overall, Medicare acts as a safety net for healthcare costs as people age or face health challenges, ensuring access to necessary medical services.

What If I'm Under 65?

Even though Medicare is primarily for older individuals, it’s good to start thinking about coverage early so you’re prepared.

You might actually qualify for Medicare before hitting 65 if:

- You have been receiving Social Security Disability Insurance (SSDI) for about two years

- You are dealing with End-Stage Renal Disease (ESRD)

- You have been diagnosed with ALS (Lou Gehrig’s disease)

If any of these apply to you, you could be eligible for Medicare sooner than you thought. Feel free to reach out to our team and we can help determine your eligibility.

Otherwise, the best thing you can do is educate yourself prior to turning 65 so you’re ready to be covered!

Check out ourMedicare FAQ‘s for more information.

How To Prepare For Medicare

Learn The Basics

Take some time to understand the different parts of Medicare.

Part A covers hospital stays, Part B covers doctor visits, Part C is Medicare Advantage (which bundles A and B), and Part D is for prescription drugs. Knowing what each part offers will help you make informed decisions later on.

Mark Your Calendar

If you think you might qualify for Medicare, keep an eye on the 7-month enrollment window.

This window starts three months before your eligibility date (typically your 65th birthday) and ends three months after, so being aware of these dates can help you avoid any gaps in coverage.

You can always contact our team and we’ll call you back during your eligibility window.

Check Your Work History

Look into your work history to see if you’ve paid Medicare taxes for at least 10 years, as this typically qualifies you for premium-free Part A.

If you’re unsure, you can check your Social Security statement online, which provides details about your eligibility. You can also contact our team and we’ll walk you through finding this information out.

Plan For Costs

Start budgeting for potential out-of-pocket expenses like premiums, deductibles, and co-pays that come with Medicare coverage.

Understanding these costs early on will help you manage your finances better when you transition to Medicare. If you have questions about potential costs, feel free to reach out to our team.

What If I'm Over 65?

If you’re already over 65 years of age and haven’t enrolled in Medicare, don’t panic!

If you’re within the 3 months after your 65th birthday window right now, please contact us today and we’ll get you covered as soon as we can. Getting covered within the eligible window helps prevent late enrollment penalties.

If the 3 month window has already passed, here’s what you need to know:

- Check Your Current Coverage: If you’re still working and have health insurance through your employer, you might not need to enroll in Medicare right away. However, it’s crucial to understand how your current coverage compares to Medicare.

- Special Enrollment Period: You may be eligible for a Special Enrollment Period (SEP) if you delayed Medicare enrollment because you had other coverage. This SEP allows you to sign up without penalties, typically within 8 months of losing your other coverage.

- Late Enrollment Penalties: Be aware that if you didn’t sign up when you were first eligible and don’t qualify for an SEP, you might face late enrollment penalties. These can increase your Medicare premiums permanently.

- Immediate Action Steps: If you’re ready to enroll, you can reach out to our team by phone, email, or in-person at our office. We’ll be happy to help you figure out how to get covered. Don’t delay further to avoid additional penalties or gaps in coverage.

- Seek Assistance: If you’re unsure if you’re ready to enroll or still have more questions, please consider contacting the Mair Agency for personalized counseling about your Medicare options and how to proceed.

Remember, it’s never too late to get the coverage you need. The sooner you act, the better positioned you’ll be to manage your healthcare costs and ensure comprehensive coverage.

How Can I Learn More?

If you want to dive deeper into Medicare, feel free to explore the resources throughout our site.

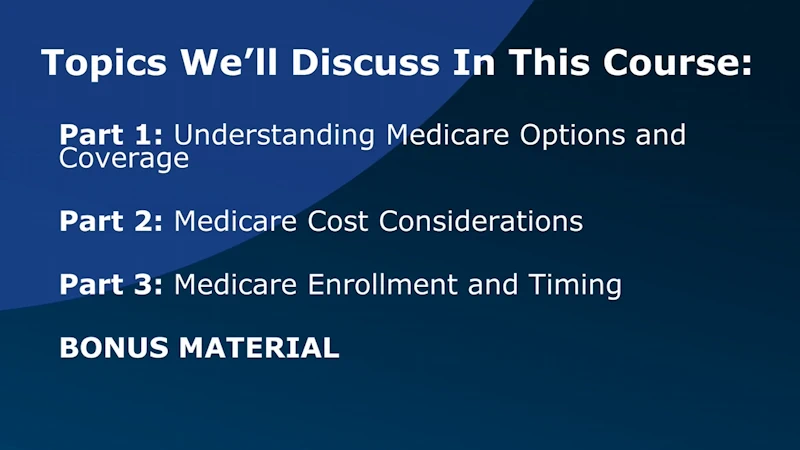

We also offer a short, under 30-minute introductory video course presented by our lead agent, Daniel Turner, designed to give you a clear and easy-to-understand overview of Medicare. It’s the perfect way to get started and feel confident about your healthcare choices.

Getting Covered, Made Easy

Save yourself time and effort with guided assistance by The Mair Agency.

Our team has years of experience helping individuals get healthcare coverage – with our expertise being Medicare.