Blue Value could be a good fit if you want savings on your monthly premium and don’t have a strong doctor or hospital preference, or if you know your doctor or hospital is already in the limited network.

Blue Value Offers

- Lower costs through a limited network of providers and pharmacies

- Two ways to pay for medical expenses: a plan with predictable copayments or deductible and coinsurance

Availability

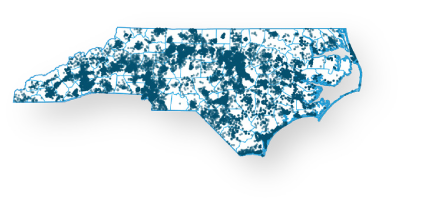

Blue Value is available to residents of these North Carolina counties:

- Alamance

- Alexander

- Anson

- Brunswick

- Burke

- Cabarrus

- Caldwell

- Caswell

- Catawba

- Chatham

- Columbus

- Davidson

- Davie

- Duplin

- Durham

- Forsyth

- Iredell

- Lee

- Mecklenburg

- New Hanover

- Onslow

- Orange

- Pender

- Person

- Rowan

- Stanly

- Stokes

- Surry

- Union

- Yadkin

Out-of-Network (OON) deductible and OON out-of-pocket maximum (OOPM) are two times the in-network deductible and in-network OOPM. Member pays 30% more coinsurance when seeking services out of network – integrated prescription drug benefits subject to the same deductible & coinsurance as other medical services. Prescription drug deductible must be met before receiving benefits. Emergency room copay is $500 on Silver & Gold metallic copay plans and $300 on Platinum copay plans, and subject to deductible & coinsurance on Bronze and Catastrophic plans.